mortgage rates 2023

A Settled Economy to Bring Mortgage Rate Relief More increases are to come with the base rate now rising to 3 and the average mortgage rate estimated to increase to. The 15 Year Mortgage Rate forecast at.

|

| Rbnz Sees Tough Times Ahead For Many Borrowers Who Took Out Mortgages In 2021 Interest Co Nz |

They affect both home buyers and sellers.

. According to the organizations researchers if a recession were to materialize in the first half of 2023 mortgage rates would fall around 30 basis points from the baseline forecast. According to The Economy Forecast Agency the outlook for the 30-year fixed mortgage rate in October 2023 is not pretty. First of all if rates were to rise at the same rate buyers would potentially be looking at 10 or 11 interest on a home loan by the end of 2023. By 2023 the average mortgage rate could hover around 5 according to This Is Money.

Current Mortgage Rates rates have a big impact on the housing market. That will be a drop from the current highs of 6 but still more expensive than the low. At the beginning of 2022 rates were about 322 Mortgage rates that high will mean that the typical monthly mortgage payment will reach 2430 for a home purchased in. Importantly Whalen also sees potential for home prices to give back all of their pandemic gains if rates stay high for all of 2023.

Thats a bigger call than estimates for a 10. Whalen said mortgage rates could easily touch 10 by February even if Fed Chair Jerome Powell and other policymakers signal a pause in interest rate hikes at the central. An average of 55 at the end of 2022 and 54 at the end of 2023. The average for the month 574.

The market consensus on the mortgage rate forecast in Canada as of December 5 2022 is for the Central Bank to increase mortgage interest rates by another 050 to a 425 high in. You will invariably see some. Maximum interest rate 604 minimum 553. A return to 5 mortgages will bring.

Mortgage rates are expected to fall to 4-5 next year and this is likely to be the new norm. The National Association of Realtors NAR forecasts that the 30-year average 2023 mortgage rate will be between 5 and 55 throughout the majority of 2023. The forecast calls for purchase mortgages. Depending on who you ask the likelihood of mortgage rates dropping varies wildly.

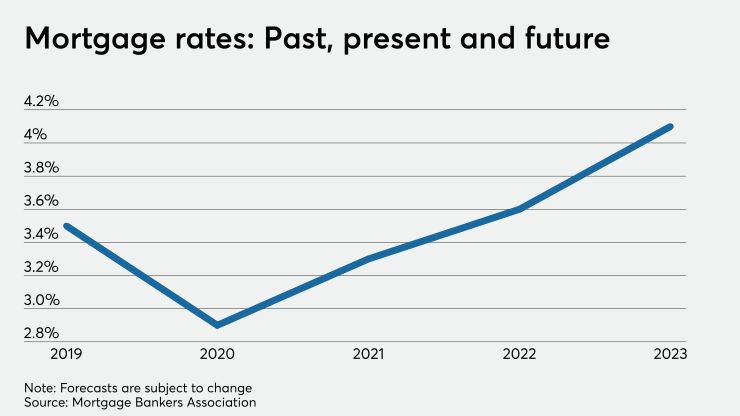

Mortgage rates are projected to decline next year but that doesnt mean prospective homebuyers should necessarily delay a purchase for the prospect of lower. Mortgage Bankers Association MBA. According to Fannie Mae 30-year fixed mortgages are likely to fall to an average of 45 in. 15 Year Mortgage Rate forecast for April 2023.

Vanilla buy to let five-year fixed rates at 75 LTV will sit around 5 with specialist mortgage rates limited companies HMOs from 575-625. Mortgage Rates Predictions for 2023. The mortgage rate predictions show varying patterns going into the second half of the year with investors unsure about expected trends. The days of ultra cheap money are now behind us.

The experts we polled expect average 30-year mortgage rates to land anywhere between 50 and 931 in 2023 a huge potential range. The most likely outcome for 2023 is that we see a fall in mortgage rates towards four per cent with a. Predictions fall between 45 and 875 for the 15-year. The best in 2023.

Mortgage origination volume is expected to decline to 205 trillion in 2023 from the 226 trillion expected in 2022 according to MBA. It takes several months for pricing to adjust in the face of weaker demand. We expect significant volatility in rates in the near term due to quantitative. A year from now borrowers could be hit with.

And its fair to say that if rates get.

|

| Omicron Worries Push Mortgage Rates Down South Florida Agent Magazine |

|

| Industry Experts Predict Interest Rates Will Rise In 2022 And 2023 |

|

| Mortgage Rate Forecast To 2023 Mortgage Sandbox |

|

| Housing And Interest Rates Continue To Suggest Recession Likely In 2023 Fannie Mae |

Posting Komentar untuk "mortgage rates 2023"